#1 Way for Millennials to GET LEADS as a New Real Estate Agent- [7 DEALS FROM 1 BUYER]

The best way to get leads as a new real estate agent is to raise your antennas, and listen – very carefully. Real estate is

For agents looking to build a profitable and enjoyable, database driven real estate business.

Explore Clientown’s Selling System, equipped with CRM, MyTown Tours, and Video Marketing Ecosystem.

The best way to get leads as a new real estate agent is to raise your antennas, and listen – very carefully. Real estate is

Without a doubt, video is the best real estate marketing strategy, but there’s a problem. You’re busy. Do you even have time to think about

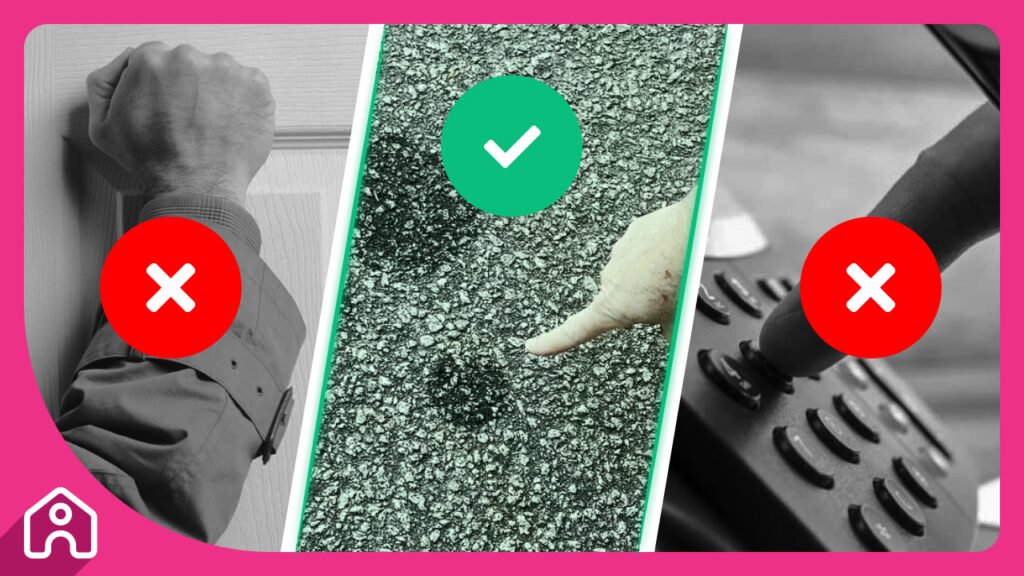

“It’s not about hard selling. It’s not about holding open houses. It’s about filling in the gaps for people from what they see on the internet and what the reality is of buying a home in your market.”

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |